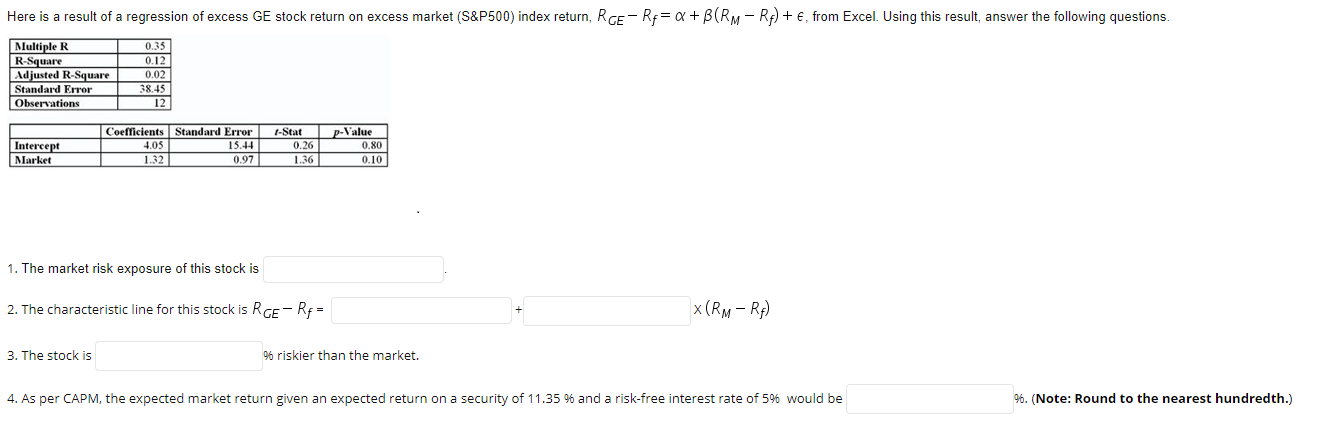

Let us take an example: when we invest in stocks, it is but human to pick stocks that have the highest possible returns. this article explains you about Beta in most basic way. If you have not heard of Beta yet, then worry not. If you have a slightest of the hint regarding DCF, then you would have heard about Capital Asset Pricing Model (CAPM) that calculates Cost of Equity as per the below Beta formula.Ĭost of Equity = Risk Free Rate + Beta x Risk Premium You may want to have a look at this Investment Banking Course here. If you wish to learn about DCF Modeling professionally, I have created a 117 course portfolio on Investment Banking. How to calculate beta of unlisted or private firmsĪ measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a wholeīeta is a very important measure that is used as a key input for Discounted Cash Flow or DCF valuations.

In this article, we look at the nuts and bolts of CAPM Beta –

CAPM Beta – When we invest in stock markets, how do we know that stock A is less risky than stock B. Differences can arise due due to the market capitalization, revenue size, sector, growth, management etc. Can we find a single measure which tells us that which stock is more risky? The answer is YES and we call this as CAPM Beta or Capital Asset Pricing Model Beta.

0 kommentar(er)

0 kommentar(er)